To thrive in a competitive market and cater to better informed customers, today’s insurance agencies have to be more customer centric than ever before. To drive customer satisfaction and eventually increase sales, insurance agencies are increasingly turning towards CRM system such as Vtiger CRM. By providing 360 degree customer view along with powerful automation, Vtiger CRM helps you deliver personalized services to increase customer satisfaction and build stronger relationship.

Make every customer interaction count

Insurance policy is an intangible product that the buyers hope to never use. So, after purchasing an insurance policy, customers rarely reach out to their agents. To back this up, a recent global customer insurance survey reveals that at the time of the survey, nearly half of the surveyed customers reported that they had not interacted with their insurance agents during the previous year. Therefore, when the number of interactions is limited, you have to make sure that every engagement counts.

With Vtiger CRM you can turn every customer interaction – be it a casual query on policy coverage or a dispute on claim – into an opportunity to build trust and loyalty, and eventually drive more sales. Let me elaborate on this with an example. Let’s say a customer has a question on the coverage of an existing policy. This could mean that the customer is trying to switch to a policy that has better coverage. And this makes the customer your high priority for retention and/or upsell. Once you’ve captured the new requirements, dig into your previous interactions recorded in Vtiger to reassess customer requirements and share policies that interests the customer. This way the customer knows that you care and helps trust building.

Stay connected with your customers always

One more interesting revelation of global customer insurance survey is that 57% of global insurance consumers wish to hear from their insurance agents at least once in 6 months. Customers are open to receiving not only policy updates and premium due reminders but also special deals and promotional content. However, less than 15% of the survey respondents were satisfied with the communication efforts of their agents. Further the survey findings note that infrequent and non-personalized communications often lead to customers closing policies or switching insurers.

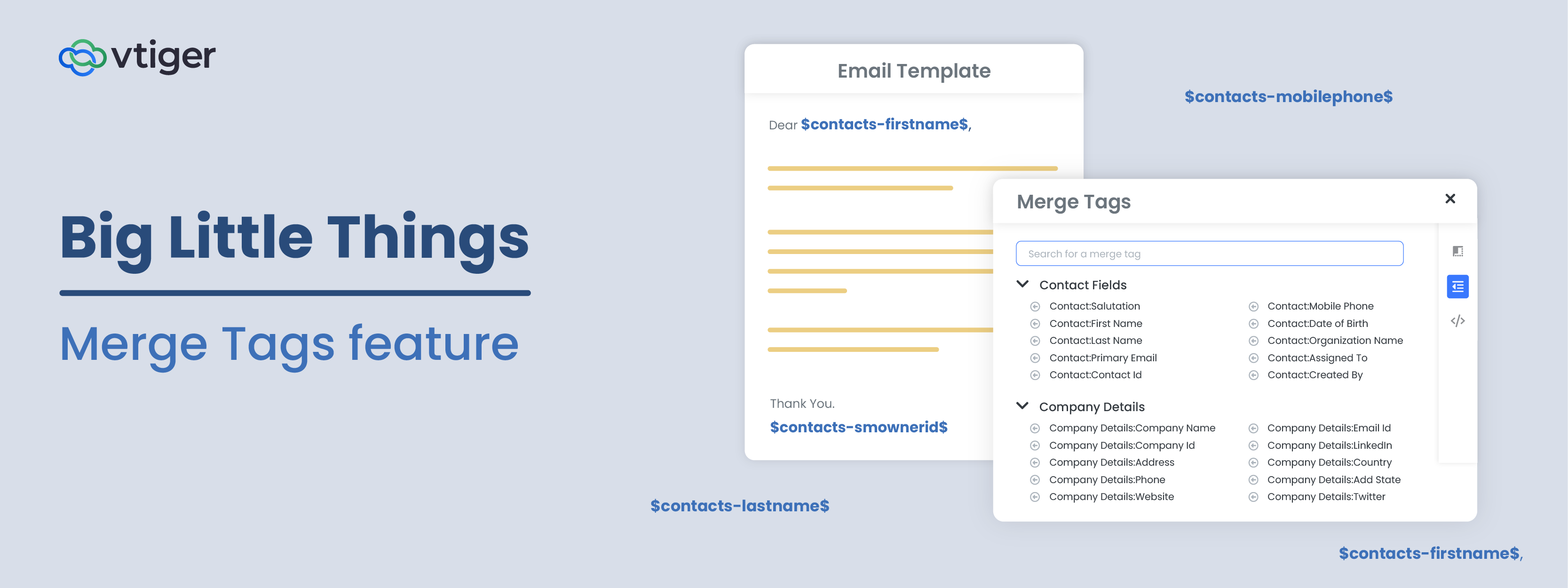

Vtiger CRM allows you to design an effective communication and engagement strategy that is customer centric and drives high customer satisfaction. To begin, filter contacts based on the policy type, region, gender, and more to create specific marketing segments you want to target. You can use this list when making targeted sales calls or sending bulk emails. When sending bulk emails, use Vtiger’s email template designer to create beautiful emails. Use merge tags to personalize every email with customer’s name, country, policy number and other details as needed. Then blast these emails to targeted segments. Generate reports on emails campaigns to analyse email opens, clicks, unsubscribes, and bounces. And use these insights to tweak your email engagement strategy.

While now you know that customers expect more engagement from their agents, you also have to keep in mind that overdoing it could be potentially annoying. So, you have to allow your customers choose what type of content they wish to receive and how frequently. Let’s say a customer no longer wants to receive your promotional emails. When unsubscribing from the list, Vtiger gives your customers an option to unsubscribe from promotions list while they opt to still receive product updates and newsletter. This way you can align your engagement strategy with your customers needs, and build strong relationships.

Streamline data collection and document management

Every day insurance agents deal with a ton of data. Managing insurance applications, customer files, policy claims, forms, disclosures, and contracts involve exchanging of information and documents between customers and agents. However, if you rely on papers for sharing these information, then the chances of losing documents, misfiling, and spending too many minutes searching for information are high.

Vtiger CRM digitizes the entire data collection and document management process, helping insurance agencies go paperless and improve operational efficiency. One way Vtiger lets you streamline data collection and document management is through customer portal. Vtiger allows you to create a portal for every policyholder. Customers can login into the portal to raise claims, submit supporting documents, and track progress in real time. When a customer submits documents, they are automatically attached to the customer’s record and are easily accessible to agents and other team members involved in processing claims. In case you need customer’s signature on any documents, you can request for digital signature to authorize a documents within minutes. You can also send documents such as general declarations for internal approvals to validate the authenticity. And once the claim is successfully processed, the billing team can view all the service deductibles and send the billing report to clients. When a claims processing team members find everything they need in one place, they can reduce the number of back-and-forth interactions, unwanted delays and claim handling complaints.

Beyond efficient data collection and management, Vtiger CRM provides powerful workflows to accelerate sales process. Vtiger lets you generate custom reports on CRM data to get deeper insights on what interests your customers. Further, appointment page, task manager, smart notifications, integration with 3rd party applications help you get things done in less time. Sign up for a 15 day trial to experience how Vtiger CRM helps you improve customer satisfaction.